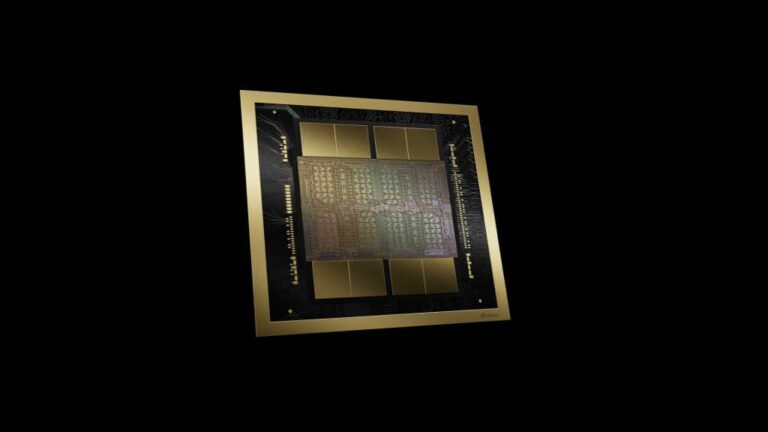

China is a mere three years behind TSMC in some chip technology

China’s sophistication in some of its chip technology is approaching three years behind that of top chip manufacturer Taiwan Semiconductor Mfg. Co. (TSMC) despite the best efforts by the US to delay advancements through a broad strategy of trade restrictions.

Analysis done by a Tokyo-based company called TechanaLye found a processor from a new Huawei smartphone released in April rivals TSMC chips in processing capability, according to the findings reported in Nikkei Asia. TechanaLye makes it their business to disassemble electronic devices and analyze their component technology.

TechanaLye CEO Hiroharu Shimizu showed semiconductor circuit diagrams for two application processors for Huawei smartphones to Nikkei; one was from Huawei Technologies’ Pura 70 Pro, released in April, and one from a top Huawei smartphone model from 2021, according to the report.

Huawei subsidiary HiSilicon designed the Kirin 9010 chip from the Pura 70 Pro; it was mass-produced by Semiconductor Manufacturing International Corp. (SMIC), a major Chinese contract chipmaker. The other chip design analyzed and presented was a Kirin 9000 chip, also designed by HiSilicon but produced by TSMC.

SMIC’s 7-nanometer (nm) mass-produced chip is 118.4 square millimeters, while TSMC’s 5-nm chip is 107.8 sq. mm, according to the report. In general, a smaller nanometer size means higher performance and a smaller chip. However, TechanaLye found that TSMC’s Kirin 9000 chip and SMIC’s Kirin 9010 chip were nearly comparable in performance, though a difference in yield still exists.

Are US trade restrictions failing in intent?

The findings demonstrate that despite the Biden administration’s ban on exporting certain chip technology to China in an effort to stymie development there–fearing the nation’s growing geopolitical power—the nation continues to evolve its processor technology, buoyed by a surge of activity by in-country manufacturers, Shimizu noted.

“The US regulations so far have only slightly delayed Chinese innovation, while sparking efforts by the Chinese chip industry to boost domestic production,” he told Nikkei Asia, according to the report.

Indeed, HiSilicon, which designed about 14 of 37 semiconductors in the Pura 70 Pro, also is demonstrating improvements that show Chinese progression, according to Shimizu. Other device chips — such as those for memory, sensors, power supply, display, and other functions — were from other Chinese and foreign manufacturers, with the bulk of them, or 86 percent, produced in China.

Last October, the Biden administration issued new export controls that block US companies from selling advanced semiconductors as well as equipment used to make them to certain Chinese manufacturers unless they receive a special license.

Then in mid-December, the administration expanded those restrictions to include 36 additional Chinese chip makers from accessing US chip technology, including Yangtze Memory Technologies Corporation (YMTC), the largest contract chip maker in the world. The purpose behind the regulations, according to officials, is to deny China access to advanced technology for military modernization and human rights abuse.

The results of TechanaLye’s analysis show that US restrictions may only end up affecting cutting-edge processors for servers aimed at advancing technologies such as artificial intelligence (AI) and not trickle down to technology such as smartphones, according to Shimizu.

“As long as the chips do not pose a military threat, the US is probably allowing their development,” he told Nikkei.

Further advancement would cause a ripple effect

Though it’s too soon to know if and when China will catch up to TSMC and other top manufacturers in its development of processors, if it does, it would “represent a significant shift in the global semiconductor landscape,” noted Akshat Vaid, partner, Everest Group. This likely would cause a ripple effect on global competition, geopolitics, technology, and economics.

“Such a development would diversify the semiconductor supply chain, reducing reliance on a few vendors and lessening the impact of regional disruptions,” he told Computerworld.

China’s advancement in the space also could tip the geopolitical balance in technology and trade, and create even more competition and conflict between China and Western nations, “given the strategic importance of the semiconductor industry and its broader implications for other sectors,” Vaid said.

This ultimately could spur disruptive changes in semiconductor supply-chain strategies and new policies to support domestic semiconductor industries or regulate technology transfer, security, and trade concerns, he added.